26+ reverse purchase mortgage

Web The reverse mortgage for purchase uses the equity in your home to pay for the mortgage on your new home. By borrowing against their equity.

Wyxribwf8ahwmm

Enter the ages of all titleholders on the new property.

. Web These costs include title fees appraisal fee credit report counseling wire fee and so on. In addition the loan may need to be paid back sooner such as if you fail to pay. Turn A Portion Of Your Homes Equity Into Supplemental Cash With A Reverse Mortgage Loan.

Ad 2023s Trusted Reverse Mortgage Reviews. Ad While there are numerous benefits to the product there are some drawbacks. It allows borrowers to purchase.

Ad AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. Set the mortgage balance to 0. Web A reverse mortgage increases your debt and can use up your equity.

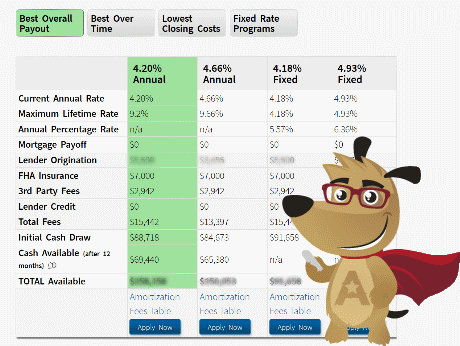

Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Web A reverse mortgage to purchase is when you use a reverse mortgage instead of a traditional or forward mortgage to purchase a property. Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator.

Comparisons Trusted by 45000000. 1 Reverse mortgage loans allow homeowners to convert their home equity into cash. Often a homeowner sells their current residence and.

Stop Worrying Start Enjoying Your Retirement. Ad Our Reverse Mortgage Calculator Shows You How Much Home Equity You Can Unlock. Web The maximum amount that can be received from a reverse mortgage loan depends on the following factors.

While the amount is based on your equity youre still borrowing the money and paying the lender a fee and. Web Reverse mortgage loans generally must be repaid when you sell or no longer live in the home. If youre eligible for a reverse mortgage and decide its the right move for you and.

Free Reverse Mortgage Calculator. Web When the tool asks for the homes value put the purchase price. Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice.

Web A reverse mortgage is a type of loan that is used by homeowners at least 62 years old who have considerable equity in their homes. Web A HECM for purchase allows seniors age 62 and older to purchase a new principal residence without required monthly mortgage payments. Age of the youngest borrower Lesser of the value of the property home.

Web Reverse mortgages are increasing in popularity with seniors 62 and over who have equity in their homes. Turn A Portion Of Your Homes Equity Into Supplemental Cash With A Reverse Mortgage Loan. Web The reverse mortgage application process typically takes between 30 and 45 days.

Web Reverse mortgages provide individuals ages 62 and older with income in the form of a loan using the equity in their homes. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Home equity conversion mortgage proprietary reverse mortgage and single-purpose reverse.

Web There are three major types of reverse mortgage loans. Be at least 62 years old Have zero delinquencies on any federal debt Own your home free and clear or have 50. Web Using proceeds from the sale of your current home or cash on hand you make a down payment usually 40 to 50 of the cost of the new home and cover closing costs.

Web General reverse mortgage requirements include the following. Web There is a Home Equity Conversion Mortgage HECM for Purchase loan that allows people 62 and older to purchase a new principal residence with HECM loan. For the origination fee reverse mortgage lenders are allowed to charge you up to.

Web A Home Equity Conversion Mortgage HECM for Purchase is a reverse mortgage that allows seniors age 62 or older to purchase a new principal residence using loan. Web A reverse mortgage is a type of home loan for seniors ages 62 and older. The three types of reverse mortgage.

Ad AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. Compare a Reverse Mortgage with Traditional Home Equity Loans. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. A reverse mortgage enables you to withdraw a portion of your homes.

Loans Made Easy Breeze Funding Low Rates

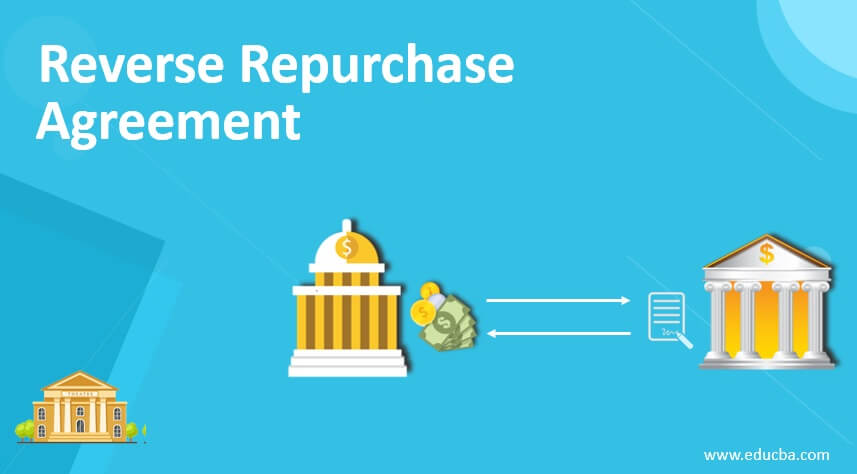

Reverse Repurchase Agreement Purpose And Components Of Rra

How Do I Refinance My Reverse Mortgage

Letter Of Intent To Purchase Land 10 Examples Format Sample Examples

Reverse Mortgage Calculator Reverse Mortgage

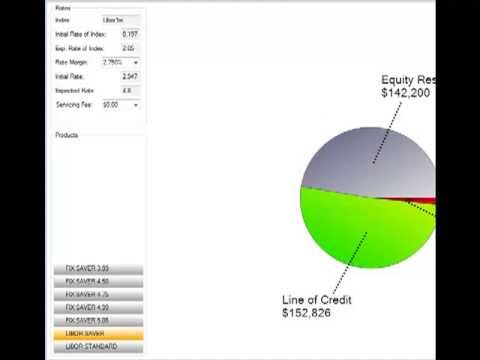

Reverse Mortgage Line Of Credit Growth Rate Explained

:max_bytes(150000):strip_icc()/HomeEquity-329e5b0c0a534f5bbe7e441137b00485.jpeg)

Reverse Mortgage Guide With Types And Requirements

Reverse Mortgage Calculator

Reverse Purchase Mortgage Mortgage Investors Group

Reverse Mortgage For Purchase Guidelines Home Central Financial

Reverse Mortgage Purchase Down Payment Rates Eligibility

Reverse Mortgage Technical Stuff Reverse Mortgage Guide Section 2 Article 6 Hsh Com

Reverse Mortgage Line Of Credit Growth Rate Explained

Reverse Mortgage Purchase Down Payment Rates Eligibility

What Is A Reverse Mortgage How Does It Work Arlo

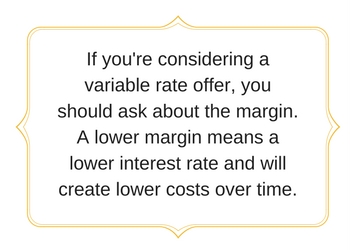

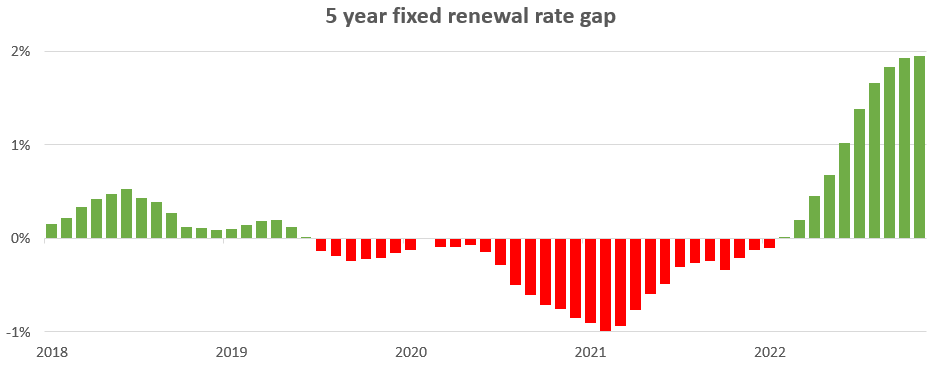

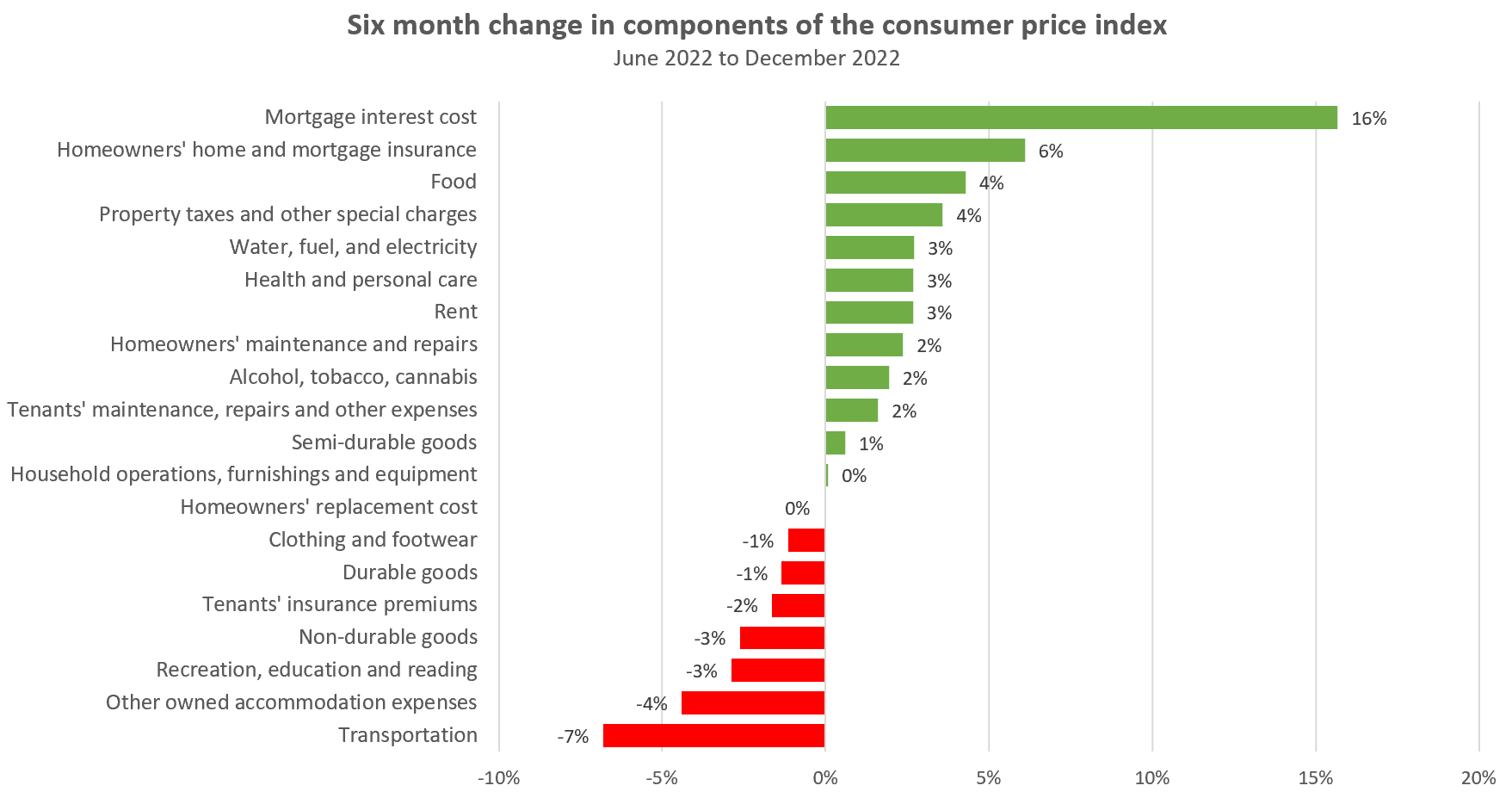

Changing Rates And The Market House Hunt Victoria

Changing Rates And The Market House Hunt Victoria